Mid-market sets sights on global trade growth

As the global economy continues to display what the IMF calls “remarkable resilience,”

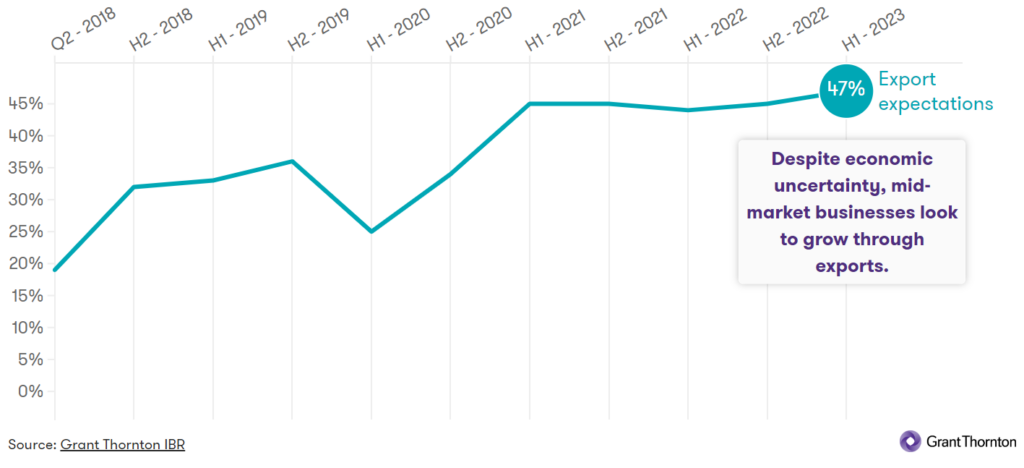

mid-market business leaders are being emboldened to explore new export markets in the search to add growth to their revenues. [i]The latest International Business Report (IBR) data shows that mid-market firms have high expectations for global trade, with 47% expecting to increase exports over the next 12 months, an increase of two percentage points compared to the second half of 2022. This is the highest proportion of businesses expecting an increase in exports in over a decade of IBR data.

mid-market business leaders are being emboldened to explore new export markets in the search to add growth to their revenues. [i]The latest International Business Report (IBR) data shows that mid-market firms have high expectations for global trade, with 47% expecting to increase exports over the next 12 months, an increase of two percentage points compared to the second half of 2022. This is the highest proportion of businesses expecting an increase in exports in over a decade of IBR data.

Regionally, the picture is more varied

In North America and despite a strong dollar, more than half (52%) of mid-market firms expect an increase in exports, reflecting the relative strength of the US economy and the outlook of businesses there. The figure is slightly below recent highs of 57%, but still demonstrates significant appetite for growth abroad. This has been underpinned by stronger business investment and resilient consumption in the region, with the IMF recently upgrading its growth forecast for the United States. [ii]

increase in exports, reflecting the relative strength of the US economy and the outlook of businesses there. The figure is slightly below recent highs of 57%, but still demonstrates significant appetite for growth abroad. This has been underpinned by stronger business investment and resilient consumption in the region, with the IMF recently upgrading its growth forecast for the United States. [ii]

In EMEA, two in every five (41%) firms plan to increase exports, while in Asia-Pacific the figure has risen steadily over the last year, up from 37% in the first six months of 2022, to 47% in 2023, owing to key successes such as Japanese economic growth. A recent update from the WTO states that although trade has slowed, growth is set to pick up in 2024. [iii] With such a varied business outlook across the regions, picking the right markets will be key to success.

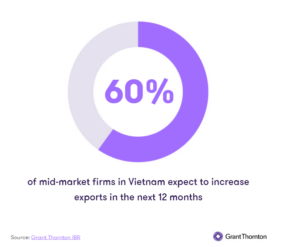

Countries where firms are particularly ambitious for non-domestic expansion include India, Indonesia, Turkey, Vietnam, Brazil, Nigeria, the Philippines and the United States. GDP growth has been particularly high in these countries too – often fuelled by export markets – with India’s GDP growth at 6.5%, and the United States reporting 2.1% GDP growth in the second quarter of 2023. [iv, v] Brazil’s Finance Ministry also raised its projection for economic growth in 2023 to 3.2%. [vi]

“Businesses need to do their research in developing new markets. Understanding what’s happening in respective markets in any given period is key. Different markets ask for different things. Product needs in Asia may be different from Europe. There is also benefit in accessing government global trade organisations, as they can be useful in helping businesses understand the nuances of different export markets. Prioritising certain countries, diversifying the client base and not spreading yourself too thin is more likely to result in success and make more sense economically.” – David Munton, Global Leader, International capabilities and support, Grant Thornton International

“Businesses need to do their research in developing new markets. Understanding what’s happening in respective markets in any given period is key. Different markets ask for different things. Product needs in Asia may be different from Europe. There is also benefit in accessing government global trade organisations, as they can be useful in helping businesses understand the nuances of different export markets. Prioritising certain countries, diversifying the client base and not spreading yourself too thin is more likely to result in success and make more sense economically.” – David Munton, Global Leader, International capabilities and support, Grant Thornton International

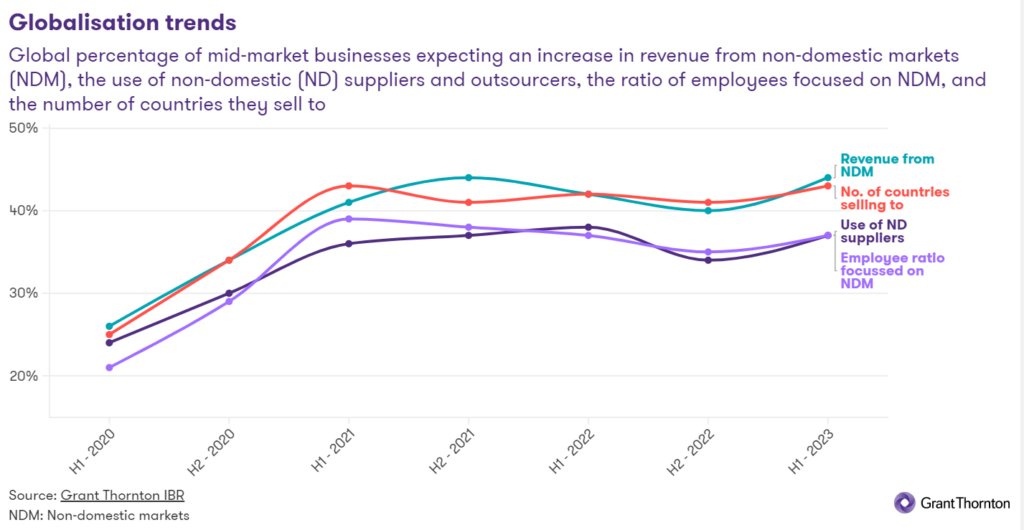

The increase in expectations for exports is reflected in an uptick in revenue expectations. Globally, 44% of mid-market firms are forecasting an increase in revenue from non-domestic markets over the next 12 months, up four percentage points from 2022. Firms may be planning to boost activity with existing trade partners, but many are also intending to increase the number of markets they operate in, with 43% looking to expand the number of countries they sell to. Likewise, 37% of firms expect to increase the ratio of their employees focussed on non-domestic markets, whilst globally, 37% of firms also expect an increase in their use of non-domestic suppliers and outsourcing in the coming year.

“Recently we have seen an increase in pricing particularly with food and raw materials. This presents the mid-market with a real challenge: how to be more competitive when importing and reselling goods locally, amid exchange rate variation and increased overall taxation due to higher pricing and currency. To overcome this, businesses are exploring opportunities like increasing domestic transactions to avoid the currency and exchange rate variation.” – Sabrina Lawder, International tax partner, Grant Thornton Brazil

“Recently we have seen an increase in pricing particularly with food and raw materials. This presents the mid-market with a real challenge: how to be more competitive when importing and reselling goods locally, amid exchange rate variation and increased overall taxation due to higher pricing and currency. To overcome this, businesses are exploring opportunities like increasing domestic transactions to avoid the currency and exchange rate variation.” – Sabrina Lawder, International tax partner, Grant Thornton Brazil

Navigating supply chain instability: Adapt and overcome

Geopolitical tensions have transformed supply chains. Russia’s invasion of Ukraine and global trade disputes continue to create challenges for firms planning for the long-term stability of their logistics networks. As a result, businesses have worked to diversify their trade routes to mitigate any risks associated with being overly reliant on a small number of markets. [vii] One of the major beneficiaries of this move has been Vietnam. IBR data shows that the country’s export expectations jumped in 2022 when four in five firms (80%) expected to increase their exports. Though expectations have fallen slightly since then, almost two thirds (60%) of mid-market firms in Vietnam expect to increase exports in the next year, as the country benefits from shifting trade networks. Export-led growth has helped to improve the economy, and the country has more recently also won a big role in the tech value chain. [viii]

disputes continue to create challenges for firms planning for the long-term stability of their logistics networks. As a result, businesses have worked to diversify their trade routes to mitigate any risks associated with being overly reliant on a small number of markets. [vii] One of the major beneficiaries of this move has been Vietnam. IBR data shows that the country’s export expectations jumped in 2022 when four in five firms (80%) expected to increase their exports. Though expectations have fallen slightly since then, almost two thirds (60%) of mid-market firms in Vietnam expect to increase exports in the next year, as the country benefits from shifting trade networks. Export-led growth has helped to improve the economy, and the country has more recently also won a big role in the tech value chain. [viii]

Appetite for finding revenue through working with foreign partners is undiminished, but supply chain fragmentation poses a challenge for business leaders – firms will need to be continually reviewing their trade networks with the aim of mitigating risk.

David Munton adds: “Global events, including conflicts, continue to shape trade and supply chains. Businesses have got a lot better at anticipating change, modelling it through scenarios, and building greater resilience. Lessons have been learned and I think companies are now in a much stronger place to respond to unanticipated shocks than they were five or ten years ago.”

Mid-market leaders plan for global growth

The mid-market has shown a continuing appetite to grow internationally, with IBR data for 2023 indicating that more businesses are expecting an increase in exports than at any point over the last ten years. This comes despite concerns about geopolitical tensions forcing firms to reconsider their trade networks. The fact that the mid-market continues to find ways to develop through partnerships in non-domestic markets illustrates the pioneering entrepreneurship of business leaders. But, to be successful over the long term, business leaders will need to ensure they have the management information and the business plans in place so that they can navigate any changing circumstances in global trade conditions.

Top three takeaways for your business